Identifying Passive Income Pitfalls: Key Mistakes to Watch Out For

Table of Contents

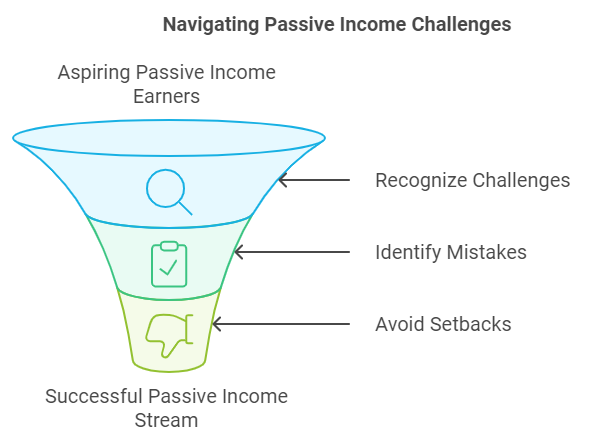

Passive income is an appealing goal for many people seeking financial freedom.

However, the journey to establishing a successful passive income stream can be fraught with challenges.

It’s important to recognize potential pitfalls that might hinder your progress.

By identifying common mistakes early on, you can navigate your path more effectively and avoid costly setbacks.

Overlooking Research and Planning

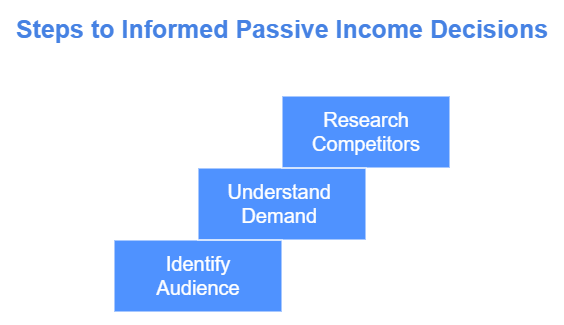

One of the biggest mistakes people make when pursuing passive income is diving in without adequate research. Rushing into an investment or business model without understanding the market can lead to poor decisions. Take the time to study your options:

- Identify your target audience.

- Understand the demand for your product or service.

- Research competitors and their strategies.

By doing thorough research, you can make informed choices that align with your goals, reducing the risk of failure.

Setting Unreasonable Expectations

Many individuals assume that passive income will flow effortlessly. However, it’s critical to have realistic expectations. While passive income can eventually require less effort, the initial setup will often demand significant time and energy. Don’t expect instant gratification:

- Be prepared for initial challenges.

- Understand the time it may take to start earning.

- Celebrate small milestones to stay motivated.

By acknowledging the journey ahead, you can maintain a positive outlook while working toward your goals.

Neglecting to Diversify

A common mistake in pursuing passive income is focusing solely on one income stream. Relying on a single source can be risky, especially if the market changes or unforeseen circumstances arise. To protect yourself, consider diversifying your income streams:

- Invest in stocks, real estate, and alternative assets.

- Create multiple online revenue sources, such as affiliate marketing or digital products.

- Build a portfolio that includes different investment types.

Diversification can help mitigate risks and enhance your overall earning potential.

Ignoring the Importance of Automation

While the goal of passive income is to create systems that work for you, many entrepreneurs forget the importance of automation. Failing to automate can lead to burnout and time management issues.

To truly achieve passive income, implement systems that will work without your constant supervision. Consider:

- Utilizing email marketing for sales funnels.

- Employing automated social media posting tools.

- Setting up recurring billing for subscriptions or memberships.

By automating your processes, you free up valuable time to focus on scaling your business.

Underestimating Required Skills

Many individuals mistake passive income as a “get-rich-quick” scheme, leading to a lack of necessary skill development. Whether it’s mastering digital marketing, understanding SEO, or learning financial management, building the right skills is critical for success.

To avoid this pitfall:

- Invest in online courses or workshops.

- Engage with communities and forums to learn from others.

- Practice and apply new skills regularly.

A commitment to continuous learning can significantly improve your chances of success.

Failing to Track Progress

Neglecting to measure and analyze your results can lead to stagnation. Without tracking, it’s difficult to determine what works and what doesn’t.

Therefore, make it a habit to assess your progress regularly:

- Set key performance indicators (KPIs) for your ventures.

- Utilize analytics tools to monitor performance.

- Adjust your strategies based on data and feedback.

By keeping a close eye on your performance, you can identify areas for improvement and make informed decisions moving forward.

With the right knowledge and strategies, you can navigate the obstacles on your journey toward passive income. By avoiding common pitfalls, setting realistic expectations, and continuously learning, you can build a sustainable source of revenue that works for you. Stay informed, be patient, and always be willing to adapt to the changing landscape of passive income opportunities.

Strategies for Building a Sustainable Passive Income Stream

Creating a sustainable passive income stream can offer financial freedom and security. However, it requires careful planning and execution. To start building your income stream, consider the following strategies that can set you on the right path.

Understand Your Options

Different methods can help you earn passive income. Familiarize yourself with a variety of options:

- Real Estate Investment: Purchasing rental properties can generate consistent monthly income. On the flip side, be prepared for property management responsibilities and potential market fluctuations.

- Dividend Stocks: Investing in stocks that pay dividends can offer a steady income. Look for companies with a strong history of dividend payments and growth.

- Peer-to-Peer Lending: Platforms like LendingClub allow you to lend money to individuals in exchange for interest payments. Assess the risks of default before investing.

- Creating Digital Products: Write an e-book, create an online course, or develop an app. Once created, these products can generate income with minimal ongoing effort.

- Affiliate Marketing: Promote products or services through unique affiliate links on your website or social media. You earn a commission for each sale made through your link.

Focus on Quality Over Quantity

It might be tempting to pursue every passive income idea that comes your way. However, choosing a few high-quality opportunities can lead to better results.

Assess each option carefully. Consider the amount of time and money you need to invest and whether you have the necessary skills or knowledge. Aim for ventures that align with your strengths and passions. A focused approach will often yield better, more sustainable results than spreading yourself too thin.

Do Your Research

Before diving into any investment, conduct thorough research. Understanding the potential risks and rewards can save you from costly mistakes. You can:

- Read Articles: Explore blogs and websites dedicated to passive income.

- Join Forums: Engage with communities on platforms like Reddit and Quora. Learn from others’ experiences.

- Seek Expert Advice: Consider consulting with financial advisors or industry experts.

Knowledge can empower you to make informed decisions and create a robust income stream.

Start Small and Scale Up

Building a passive income stream takes time. Rather than aiming for massive profits right away, focus on starting small. This approach allows you to:

- Test Your Ideas: Start with a smaller investment or project to evaluate its success before you commit more resources.

- Learn and Adjust: Use initial results to refine your strategies. Each step can bring valuable insights that shape your future efforts.

- Build Confidence: Small successes can motivate you to explore larger opportunities down the line.

Be Patient and Stay Committed

Successful passive income generation doesn’t happen overnight. It’s crucial to remain patient and committed. You may experience ups and downs along the way. It’s vital to stay focused on your goals and adapt when necessary.

Monitor your investments and income sources regularly. Set aside time to evaluate what’s working and what’s not. This practice can help you make informed decisions and adapt to changing market conditions.

Automate When Possible

One of the key components of passive income is automation. By setting up systems that work on their own, you can free up time and reduce your workload.

Consider:

- Auto-Pay for Bills: Ensure your income-generating assets have their costs covered automatically.

- Using Tools: Employ tools that manage your investments or sales processes without needing constant oversight.

Automation not only contributes to efficiency but also ensures that your efforts can run smoothly with minimal involvement.

Through understanding your options, focusing on quality, researching thoroughly, starting small, committing to your goals, and automating processes, you can build a sustainable passive income stream. Remember that success is a journey, often requiring time and persistence. With the right strategies, you can achieve financial freedom and security in your life.

The Importance of Research in Avoiding Passive Income Failures

When embarking on the journey to earn passive income, many enthusiasts dive in headfirst, driven by dreams of financial freedom. However, without proper research, this ambition can quickly lead to disappointment. The importance of thorough research cannot be overstated; it can be the difference between success and failure in the quest for passive income.

Knowing Your Options

Before you invest time or money, it’s essential to know what passive income streams are available.

There are various avenues, such as:

- Real estate investments

- Dividend stocks

- Peer-to-peer lending

- Creating digital products

- Building a blog or a YouTube channel

Researching these options allows you to identify what aligns with your skills and interests. It also helps you gauge the risks involved and the potential returns. Without this knowledge, you might end up pursuing a path that isn’t right for you, leading to wasted time and resources.

Understanding the Risks

Every investment carries risks. Failure to acknowledge these risks is one of the most common pitfalls in passive income ventures.

Consider the following:

- Market volatility can affect stock investments.

- Real estate markets can be unpredictable.

- Digital products often require constant updates and marketing.

Proper research equips you with an understanding of the potential pitfalls associated with each income stream. This insight allows you to make informed decisions and apply risk management strategies that can safeguard your investment.

Learning from Others

When starting any passive income endeavor, it’s wise to learn from those who have tread the path before you. The online community is rich with resources, from blogs to forums. Engaging with seasoned investors can provide invaluable learning opportunities, showing you what to expect and common mistakes to avoid.

Many online platforms offer candid testimonials from real people. These stories can outline both successes and failures, providing you with a realistic perspective on what could await you.

Evaluating Profitability

Not every passive income model will generate significant profits; some might not even break even. Researching the profitability of different avenues involves analyzing market trends, understanding audience demands, and even reviewing the competition.

You can ask yourself:

- Is there a market for my product or service?

- Who are my competitors, and what are they doing well?

- What pricing strategies work best in my chosen field?

Understanding these dynamics will help you identify which income streams may be worth pursuing and which ones should be avoided.

Staying Informed

The landscape of passive income is ever-evolving. Trends change, and new opportunities emerge regularly. Therefore, continuous research is vital to remaining relevant and competitive.

Consider subscribing to relevant newsletters, joining networking events, or taking online courses. Staying ahead of the curve ensures that you adapt your strategies based on the latest information and trends in the market.

Setting Realistic Expectations

Another critical aspect of research is understanding that not every passive income stream will yield immediate results. It’s easy to fantasize about quick riches, but the reality often involves hard work and dedication.

Do your homework on timelines and expected outcomes for various income streams. This preparation can prevent disillusionment and help you remain motivated, even when success takes longer than anticipated.

Implementing Fail-Safe Strategies

A good research strategy involves developing fail-safe plans. Think about what you would do if a venture doesn’t go as expected.

Ask yourself:

- Can I pivot to another strategy?

- What’s my exit plan if I want to cut my losses?

- How will I maintain a steady income while transitioning to a new model?

Preparing for setbacks is a fundamental part of any income strategy. By studying various scenarios and crafting contingency plans, you bolster your chances of long-term success.

Embarking on the journey toward passive income without adequate research is like sailing without a map. Knowledge is your compass, guiding you through the waters of investment, helping you avoid common pitfalls and navigate toward fruitful opportunities. By understanding your options, risks, and staying informed, you increase your chances of building a sustainable passive income stream that meets your financial goals.

Tools and Resources to Help Navigate Passive Income Opportunities

When it comes to exploring passive income opportunities, having the right tools and resources can make all the difference. Whether you’re a seasoned entrepreneur or just starting out, these tools can help streamline your efforts, maximize your potential, and minimize your risks. Here’s a closer look at some essential tools and resources that can guide you on your journey.

Online Courses and Educational Platforms

Learning is a crucial step in understanding the various available passive income options.

Here are some platforms that can help you educate yourself:

- Udemy: Offers a plethora of courses on various passive income streams, from real estate investing to online courses creation.

- Skillshare: Features creative classes, including freelancing and digital marketing, which can lead to passive income opportunities.

- Coursera: Provides university-level courses that cover topics like finance and investment strategies, essential for making informed decisions.

Investment Platforms

Investing wisely is a significant aspect of generating passive income.

These platforms can help you manage your investments effectively:

- Robo-Advisors: Services like Betterment and Wealthfront automatically manage your investment portfolio based on your goals and risk tolerance.

- Real Estate Crowdfunding: Websites like Fundrise and RealtyMogul allow you to invest in real estate projects without having to buy properties outright.

- Stock Market Apps: Use apps like Robinhood or Acorns to simplify stock investments while enjoying perks like fractional shares.

Automation Tools

Automating your processes can save time and help you focus on strategies that generate income:

- Zapier: This tool connects different apps and automates tasks, minimizing the manual work needed to manage your income streams.

- IFTTT: Similar to Zapier, this platform helps automate routine tasks across your devices and apps, keeping everything running smoothly.

- Mailchimp: Manage your email marketing efforts effectively. Use it for automated newsletters promoting your services or products to your subscribers.

Financial Planning Tools

Understanding your finances is critical to your success. These tools can help you track and manage your funds:

- Mint: A budgeting tool that offers an overview of your income, expenses, and savings, helping you make better financial decisions.

- YNAB (You Need A Budget): This tool helps you create a budget and stick to it, ensuring you’re allocating funds effectively toward your passive income projects.

- Personal Capital: This tool combines budgeting and investment tracking, offering insights into your overall financial health.

Networking and Community Resources

Connecting with like-minded individuals can enhance your journey. Here are some platforms for networking:

- Meetup: Find groups in your area focused on passive income strategies and investment opportunities.

- Reddit: Subreddits like r/investing and r/passive_income offer valuable discussions, tips, and shared resources.

- Facebook Groups: Join groups dedicated to passive income strategies to share experiences and gain insights from fellow entrepreneurs.

Content Creation and Marketing Tools

If your passive income strategy involves creating content, make use of these helpful tools:

- Canva: Easily create engaging graphics for your blog posts or social media promotions.

- WordPress: A robust platform for blogging, helping you set up a website quickly and easily to share your insights.

- Buffer: Streamline your social media management to ensure consistent content promotion across multiple platforms.

Utilizing these tools and resources will help you navigate the world of passive income more effectively. Each resource serves a unique purpose, enhancing your ability to create a sustainable income stream. By embracing these tools, you can focus on what truly matters: growing your income and achieving your financial goals.

Real-Life Examples of Passive Income Successes and Failures

The text explores various real-life examples of passive income successes and failures, highlighting the importance of careful planning and research. It begins with Graham’s success story in rental properties, where his methodical approach to property selection, renovation, and tenant screening led to sustainable income. In contrast, Emily’s rushed investment in a high-crime area property resulted in financial losses, emphasizing the crucial role of thorough market research.

The document then discusses blogging as another passive income stream, comparing two different experiences. Lisa’s focused approach to healthy cooking content, combined with effective affiliate marketing and strong audience engagement, proved successful. Meanwhile, Kevin’s scattered approach to various topics without a clear niche failed to generate meaningful income, demonstrating the importance of targeted content creation and audience connection.

Finally, the text examines dividend stock investing through Sarah’s experience. While she initially succeeded with a dividend investment strategy, a market downturn and dividend cuts from key holdings affected her income stream. Her story illustrates the vital lesson of portfolio diversification and the risks of overreliance on specific investments in passive income strategies.

To help you navigate these success stories and challenges, consider these general tips:

- Research Diligently: Whether it’s real estate or stocks, understanding the market is crucial.

- Narrow Your Focus: Establish a niche for blogs or businesses to attract a loyal audience.

- Build Trust: Engage with your audience, foster community, and provide real value.

- Diversify Investments: Spread your investments across multiple streams to minimize risk.

- Adapt and Learn: Be prepared to pivot based on feedback and changing market trends.

Real-life examples demonstrate that passive income can lead to exceptional financial freedom, but it’s essential to learn from both successes and failures. By carefully examining the journeys of others, you can apply these insights in your quest for passive income, avoiding common pitfalls and leveraging effective strategies for generating ongoing income streams.

Conclusion

The key to passive income success lies in balancing knowledge, strategy, and action. It’s not about finding quick wins, but rather building sustainable income streams through careful planning and continuous learning. Success requires:

- Avoiding common pitfalls through proper research and risk management

- Staying adaptable and learning from both successes and failures

- Taking a patient, long-term approach rather than seeking instant results

- Maintaining ongoing education and market awareness

- Following a structured plan with clear, actionable steps

Think of it like growing a garden – it needs proper planning, regular maintenance, and time to flourish.

Your financial success similarly requires consistent attention and the right foundation to thrive.

Pingback: Guide To Investing How To Grow Your Money Smartly

Pingback: Turning Your Expertise Into Passive Income

Pingback: Guide To Creating A Sustainable Passive Income

Pingback: What Passive Income Really Means For Your Finances